#privacy

Ublock origin #adblock is on iOS now.

https://apps.apple.com/us/app/ublock-origin-lite/id6745342698

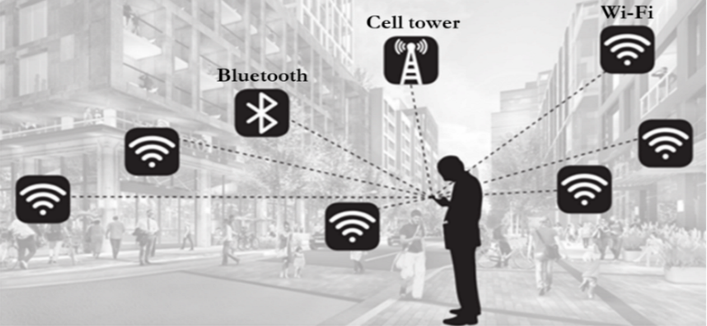

Excellent video from @BrodieOnLinux about internet #surveillance and #privacy

It made me think about, who excatly are the people behind the scenes pushing for these things in the name of "protecting our children" ?

I don't wanna go into conspiracy territory here, but some guy told some person told some politician to prioritize this. It would be interesting journalistic investigation to follow that thread.

Where does the push come from?

Who profits?

#1984 #dystopia

DATE: August 05, 2025 at 04:02PM

SOURCE: HEALTHCARE INFO SECURITY

Direct article link at end of text block below.

#Hacks on 3 Specialty #Medical Providers Affect Nearly 800,000 https://t.co/943rq3sJJt #HIPAA #healthdatabreach #ransomware

Here are any URLs found in the article text:

Articles can be found by scrolling down the page at https://www.healthcareinfosecurity.com/ under the title "Latest"

-------------------------------------------------

Private, vetted email list for mental health professionals: https://www.clinicians-exchange.org

Healthcare security & privacy posts not related to IT or infosec are at @HIPAABot . Even so, they mix in some infosec with the legal & regulatory information.

-------------------------------------------------

#security #healthcare #doctors #itsecurity #hacking #doxxing #psychotherapy #securitynews #psychotherapist #mentalhealth #psychiatry #hospital #socialwork #datasecurity #webbeacons #cookies #HIPAA #privacy #datanalytics #healthcaresecurity #healthitsecurity #patientrecords @infosec #telehealth #netneutrality #socialengineering

DATE: August 05, 2025 at 03:12PM

SOURCE: PsychBilling Coach In the News by Susan Frager

-------------------------------------------------

TITLE: Clinician finances threatened amid 2025’s insurance stock plunge

URL: https://psychbillingcoach.com/news/clinician-finances-insurance-stocks/

If it seems clinician finances are more precarious than usual, no, it’s not your imagination. You don’t have an anxiety disorder. The uncertain economy means that discretionary income for self-pay psychotherapy may be disappearing. But if it seems like dealing with insurance is worse than ever, that’s not your imagination either.

Every day, I see audits, pre-payment reviews, and new creative ways being implemented to delay, deny, or claw back payment. Credentialing and contracting seem to be taking longer, with more mistakes being made that take longer to resolve. Payers are quibbling over 90837 use again. There’s talk of reimbursement rate decreases in some locations, with tech platforms such as Alma or Headway not being exempt. If any of this matches your experience, I’m going to explain why.

The major insurers, especially the ones offering government or Marketplace plans, have been disappointing their shareholders. Profits, apparently, aren’t sufficient. (does anyone hear tiny violins playing?)

Make no mistake: the first duty of an insurance company is to the shareholders. Employers who purchase group policies are a distant second. And policyholders? Hah. Not even on the radar. Except as cost liabilities.

On July 29th, United HealthGroup reported 2025 second-quarter earnings results. Despite an increase of $12.8 billion when compared to second quarter 2024, that apparently wasn’t sufficient. UHG’s stocks decreased another 7% following the earnings call, for a total 2025 collapse of more than 44%. A (probably long overdue) Justice Department investigation into United’s Medicare Advantage “upcoding” practices probably isn’t helping things, either.

Other payers have financial “woes” too. Centene, the largest vendor of Medicaid managed care plans, reported a second-quarter loss of $253 million. Molina, Centene’s competitor in the Medicaid managed care and ACA plan market, also cut its 2025 earnings outlook. And Elevance (Anthem/Carelon) reported a 24% loss in profit to date in 2025.

Don’t let the doom and gloom mislead you. These folks are still making plenty of money! But it’s not enough to satisfy Wall Street shareholders, who expect to see hefty year-over-year profits. Which isn’t a model that is either ethical or realistically sustainable in healthcare.

Does stock outlook affect clinician finances?

Yes. Insurers are going to have to do something to increase profits enough to satisfy investors. I don’t think it takes three guesses to determine whose finances will be targeted.

Here’s looking at…us!

Any way an insurer tries to save money will result in systemic changes that negatively impact clinician finances. For instance, layoffs might worsen delays/mistakes in credentialing and contracting fewer employees to process enrollments. Personally, I’ve never subscribed to the belief that “doing more with less” produces positive results. Seems to me that if you invest less, your results will be, well…less. But hey, they’re saving money in payroll costs!

Who cares if a few clinicians are unhappy or if claims are delayed, right? Recently I had two newly-contracted practices with Aetna report that despite their contract effective dates being more than 60 days in the past, new claims are still processing “out of network.” Aetna laid off over 600 employees in 2024 and 2025. It could be a coincidence. If you believe in coincidences.

Yes, eventually, claims can be reprocessed to pay at the in-network level. But that requires clinicians to call, appeal, dispute all of which takes unreimbursed time and effort. And if claims are paid 90 days later, then Aetna gets 90 days’ worth of interest on clinician finances. In theory, state “prompt-pay” legislation requires insurers to pay interest on late claims, but often that doesn’t happen. And even when it does, the amount of interest paid is probably nowhere near what the insurance company took in during the time claims were delayed.

Check out this lovely little paragraph I found hiding in Optum Behavioral Health (United)’s provider manual:

No interest or penalty otherwise required under applicable law will be due on any claim which was initially processed timely and accurately, but which requires reprocessing as a result of the untimely execution of a Participation Agreement or amendment; or the inability to align Optum systems in a commercially reasonable period of time. (page 71, version effective Aug 15, 2024)

WOW. Optum is outright saying they can be as slow as they like with no consequences. How convenient for United’s bottom line. And how damaging to clinician finances.

There are too many examples of payer shenanigans to provide an exhaustive list, but here are a couple more. All are systematically designed to be destructive to clinician finances and the survival of practices. When practices fail or go out of network, clients can’t access affordable, competent care and claims don’t have to be paid.

• Low reimbursements ensure “Ghost Networks“ which can be literally deadly.

•

• No standardization in billing. Multiple ways to bill for telehealth. Does the payer require a taxonomy code? Why did this payer insist on contracting me with my Type 1 NPI when everyone else uses my Type 2? Etc. People make billing mistakes because it’s almost impossible to keep up with the varying expectations. Claims payment is delayed, stress increases, and clinician finances suffer as some therapists decide their mental health is more important than fighting to get that $80 owed by BC/BS for a session from 6 months ago. It adds up. Payers profit.

•

• Unilateral downcoding policies. Cigna announced that effective October 1st, they’re going to reduce 99214 and 99215 claims down to 99213. It will be up to providers to file reconsideration requests with medical records to prove their services met criteria for Levels 4 or 5. Aetna has already been downcoding for a while now. Unilateral downcoding forces a practice to face two awful choices: 1) bill for what you did and fight with documentation on every single claim in order to collect, OR, 2) bill something less, getting reimbursed even less, but without a hassle (presumably). In the non-prescribing psychotherapy world, this is the dynamic that the “you’re billing too many 90837” letters has created for years now.

•

• No provider customer service. We’re told use portals instead of calling. But when there’s a complex problem to be sorted out, there’s no one to talk to who can help. US-based employees with authority to fix the issues are unreachable. Eventually people just give up out of frustration. (I can help with this!)

•

What’s causing these “losses?”

People are utilizing their health insurance benefits more than the bean counters expected. How dare they?

Insurance executives use the term medical loss ratio (MLR) to refer to the percentage of premiums spent on claims payment. The Affordable Care Act dictates a medical loss ratio of at least 85%. Historically, payers have managed to stay close, but for second quarter 2025, these were the MLR numbers reported:

• United: 89.4%

•

• Elevance: 88.9%

•

• Humana: 89.9%

•

• CVS/Aetna: 89.9%

•

• Centene: 93%

•

Isn’t that a good thing for clinician finances? More claims being paid?

Sure, until they find a way to claw money back. Or reduce reimbursement rates to “compensate.” Or they decide to impose pre-payment reviews and/or unilateral downcoding. In the words of many of the CEO’s presenting the “disappointing” 2nd quarter results, “aggressive provider coding” is responsible for a lot of their “losses.”

Or until payers lay off more employees, complicating your ability to get contracted/credentialed, or changes made to your profile. Fewer people to program/update the systems that adjudicate and pay claims. (Yes, claims are mostly processed by AI algorithms).

Or when the “losses,” together with not-so-beautiful new legislation removing people from Medicaid and the likely ending of expanded ACA subsidies conspire to raise 2026 premiums by about 15%. United has already admitted plans to discontinue Medicare Advantage PPO policies in 2026, which will render about 600,000 seniors scrambling for different coverage that will most likely be both more expensive and with skimpier benefits.

The scariest part of all for mental health clinician finances?

Is that in the flurry of earnings reports, four of the five payers quoted specifically mentioned behavioral health as one of the leading areas of increased costs.

That Wall Street beast must be kept fed.

Need help managing the insanity of insurance billing, or fighting to keep money you earned? I’m here to help!

URL: https://psychbillingcoach.com/news/clinician-finances-insurance-stocks/

Articles can be found by scrolling down the page at https://psychbillingcoach.com/news/ under the title "In the News".

-------------------------------------------------

This robot is unaffiliated with PsychBilling Coach.

Private, vetted email list for mental health professionals: https://www.clinicians-exchange.org

Unofficial Psychology Today Xitter to toot feed at Psych Today Unofficial Bot @PTUnofficialBot

Psychology news and research articles at Psychology News Robot @PTUnofficialBot

NYU Information for Practice puts out 400-500 good quality health-related research posts per week but its too much for many people, so that bot is limited to just subscribers. You can read it or subscribe at @PsychResearchBot

Since 1991 The National Psychologist has focused on keeping practicing psychologists current with news, information and items of interest. Check them out for more free articles, resources, and subscription information: https://www.nationalpsychologist.com

EMAIL DAILY DIGEST OF RSS FEEDS -- SUBSCRIBE: http://subscribe-article-digests.clinicians-exchange.org

READ ONLINE: http://read-the-rss-mega-archive.clinicians-exchange.org

It's primitive... but it works... mostly...

-------------------------------------------------

#psychology #counseling #socialwork #psychotherapy @psychotherapist @psychotherapists @psychology @socialpsych @socialwork @psychiatry #mentalhealth #psychiatry #healthcare #psychotherapist #doctors #psychotherapist #hospital #HIPAA #privacy #BAA #patientrecords #telehealth #medicalbilling #SusanFrager

Signal of Signals - All In Podcast

Ti piacerebbe avere un Robot che fa la lavatrice? Il robot di Figure la fa

Link all'articolo : https://www.redhotcyber.com/post/ti-piacerebbe-avere-un-robot-che-fa-la-lavatrice-il-robot-di-figure-la-fa/

No one—no matter their age—should have to hand over their passport or driver’s license just to access legal information and speak freely.

Period, end of discussion, that's it.

Data leak! Are you trying to minimize Microsoft’s spying by using other products? I found a data leak.

Settings – System – Notifications. Check the settings.

I’m using LibreWolf to avoid MS Edge. But notifications were enabled, and that passes information to the Windows OS.

I had notifications for a Mastodon instance enabled in one tab, and it was going to Microsoft’s notification box.

Email in another tab, going to Microsoft’s notifications box.

LinkedIn in another tab, going to Microsoft’s notifications box.

Look further down in the picture, and you’ll see Mozilla Thunderbird for some email. Those emails aren’t in Outlook (a Microsoft product), so I thought the information was isolated. Nope. I have notifications turned on, so Mozilla is passing a certain subset of information to the Windows OS for the notifications.

I don’t know what Microsoft has done, is doing, or will do with that information, but they have access to it, with permission, if it's enabled here.

La #Suisse prévoit une #surveillance pire que celle des États-Unis | Tuta https://tuta.com/fr/blog/switzerland-surveillance-plan

#privacy #overreach #Switzerland

#Privatsphäre #Übergriff #Schweiz #VÜPF

#SphèrePrivée #excès

An update to MidoriVPN has been sent that improves the stability and security of the service

https://addons.mozilla.org/es-ES/android/addon/midorivpn/

Żeby dowiedzieć się, czy klawiatura w telefonie mnie śledzi, zapuściłem się w trzewia Reddita, nocami próbowałem rozszyfrowywać pakiety wychodzące z mojego telefonu, a przy tym prawie zainstalowałem Linuksa!

https://kopecpatrzy.pl/2025/08/05/kronika-zasadnego-szalenstwa/

CalyxOS kämpft derzeit mit massiven Problemen: Keine Updates, keine Patches seit bis zu sechs Monaten – laut heise.de ist die Zukunft ungewiss. Mehr Infos: https://www.heise.de/news/CalyxOS-Android-Custom-ROM-mit-massiven-Problemen-10510039.html #Android #CalyxOS #CustomROM #Privacy #newz

I feel sorry for the generation that's going to grow up reading stuff stolen and then contorted by AI instead of snuggling with a real book from a real master.

You can do this, but probably shouldn't: "You can have Gemini 'draw inspiration from your own photos and files'.”

9to5Google: Gemini app can now create custom storybooks, comics, and more https://9to5google.com/2025/08/05/gemini-storybooks/ @9to5Mac @technacity #Google #AI #privacy

Collaboration without surveillance? Yeah, it’s possible.

Loop Capital's cybersecurity analysts recently held a conference call, discussing emerging threats and vulnerabilities. Key insights include the rise of ransomware targeting financial sectors. Stay informed and bolster your security measures! What steps are you taking to enhance your cybersecurity strategy? #Cybersecurity #Privacy

Read more: https://short.steelefortress.com/k8tz8t

I've muted the term "online safety act" in my filter, but it's not working.

I'm bombarded by predictable posts about #surveillance and #privacy that I'm already acutely aware of.

How do I make it stop?